BTCUSDT

1D and 4H analysis

There is not a significant change in the HTF expectations since the price is moving within a range. We have just left 4H analysis below. The price has possibility to move up $32,000-$34,000 levels according to daily formation. If this occurs then, we may target below imbalance levels. But this does not mean that all imbalance levels will be filled at once. Remember the BTC bull season. During the increase of the price, BTC left many imbalances but they were filled many months later. It is best to take short-term decisions for now due to range price movement.

15-min analysis

The actual range is between $29,500 and $31,000. There is a sharp volume decrease possible due to weekend. There is a new micro-range for the last two days between $30,050 and $30,500. It is really hard to catch evert single movement since the two mentioned values are extremes of the range. The price is actually in a narrower price span. If any long or short position is filled from the current price, one should observe the expansion candle and then retracement possible to the EQ region of the current range. But it is best to take the position after the possible expansion.

XAUUSD

Daily analysis

The daily chart shows an agreement with our expectation of last week. However, the movement of the candles is not significant. The weekly close was $1,919 last week but there is a slight increase and the close of this week is $1,925. The daily premium area still is the first target to be reached. We should keep in mind that this is just a retracement movement. When the price reaches to the premium zone, we must watch the momentum of the price to decide if it is going to make a market structure break or not. Then we can think whether this is a retracement or not. LTF charts below show a bullish MSB. In any case price will somehow increase according to our predictions. However, continuation is a next issue to be cleared.

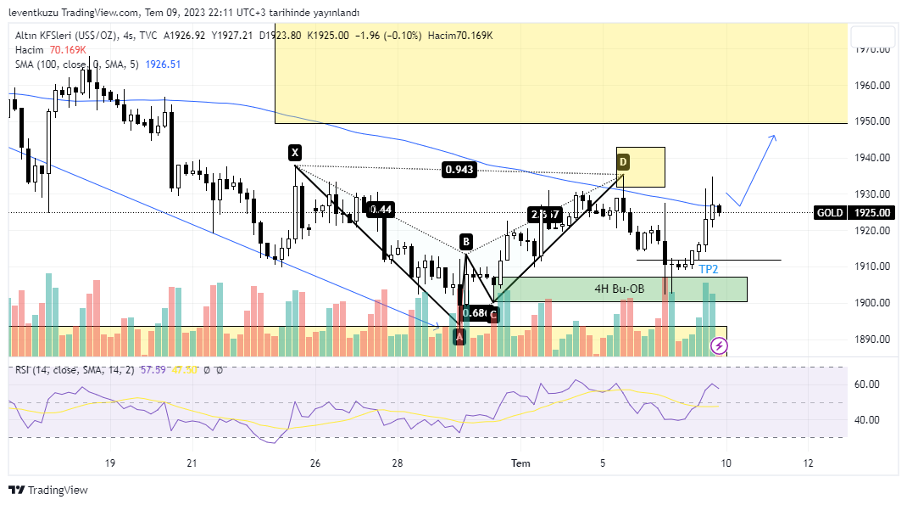

4H analysis

The emphasized bearish bat pattern worked well last week and the price made a correction. TP2 was reached and further drop was also available. The orders in 4H bullish OB was filled during this correction. After filling the remaining orders, the price started again to its bullish movement. However, MA100 still exhibits a resistance for the price of gold. The candle body always closed under MA100 curve. After the break of the curve, the target will be the area above ($1,932-$1,943), which was shown on the daily chart.

EURUSD

4H analysis

The Quasimodo pattern exhibited well last week and price dropped from breaker block to the imbalance level that are shown in the chart. As there was a descending triangle formation last week in 15-min chart, this drop was satisfactory enough for the price decrease. In the 4H time frame the price of the pair reached the swing high level, RSI is close to over-bought region, and the last bullish candle left and imbalance region. All these signs are possible indicators of retracement of the price. Two options are available that are shown this red and blue paths.

15 min analysis

The price made a market structure break within this time frame. We can observe two different bullish scenarios in 15-min chart. In the first one, price can retrace to possible entry zones mention as green boxes on the chart as order block, breaker block, and optimal trade entry. Also there is an imbalance zone in a closer distance. The second possibility is that the price is exhibiting a bullish flag. The reason is the shallow decrease of the price and also a significant momentum decrease on RSI. An instant decision should be taken to take the position. If a significant volume increase is encountered and the RSI is around EQ region, then the price can be considered as the local lowest in 15-min chart and one can consider a long position.

** Important Note: Above ideas are not investment advice!**

Nihat Çetinkaya

https://twitter.com/nhtctnk

I’m a private trader of over 7 years, based in Istanbul.

All trading and research are my opinion, not investment advice.