BTCUSDT

1D and 4H analysis

Actually, there is nothing new with the HTF analysis compared to last two weeks. The blue path was drawn last week and we did not delete it. It is clear that the price obeyed the expectation. New liquidity was taken on daily around $31,580. The drop of the price left and imbalance. Price of BTC can reach fib 0.5 level of the imbalance and continue its further decline to lower imbalance zones. But also remember the BTC bull season. During the increase of the price, BTC left many imbalances but they were filled many months later. It is best to take short-term decisions for now due to range price movement.

15-min analysis

On the lower time frame, the bearish OB can be a reasonable place for short entry. Its top price also corresponds to approximately fib 0.5 of HTF imbalance zone. $30,600-30,800s should be watched carefully for possible short positions.

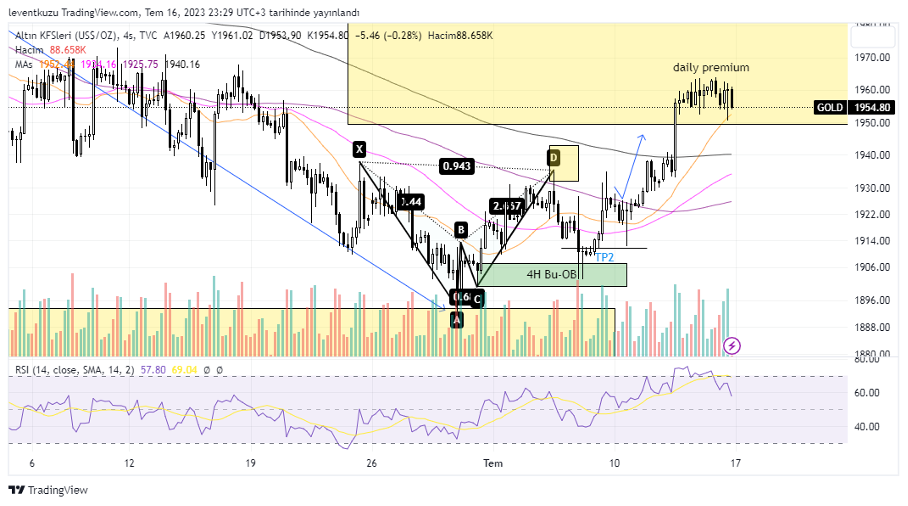

XAUUSD

Daily analysis

On the daily chart, price of gold started to move towards the daily premium zone over the last two weeks. Now the price reached a quite well zone according to the previous expectations. In such zones, we have to decide according to the action of price. The last candle takes the liquidity of the previous one so we can expect a pull back. But we need an extra confirmation on the lower time frame for a possible short entry.

4H analysis

The price started to act after filling the in 4H bullish OB last week. MA200 was broken by a strong candle, which left liquidity void. On the other hand, price couldn’t move higher than $1,964. The price is within a consolidation zone and RSI started to lose its momentum. This shows us the possible decline of the price. MA200 is just the base of the imbalance on 4H time frame. Therefore, the first target could be MA200 curve. However, all long/short position entries should be done according to LTF confirmations.

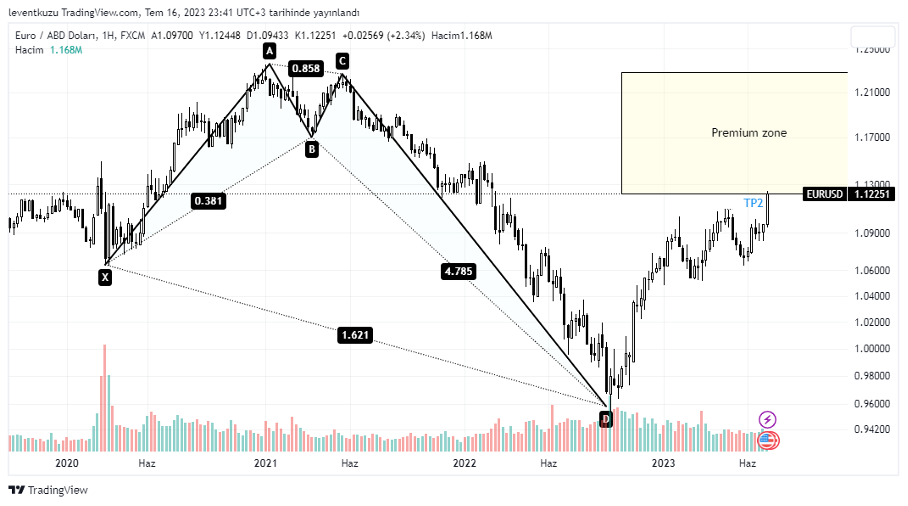

EURUSD

Weekly analysis

On the weekly chart, a clear bullish crab pattern was identified previously. We mention the importance of TP2, which is also the start of the premium zone on weekly chart. The price tried but couldn’t reach TP2 for a long time until this week. Now, the price remains in an important zone. This is where we are going to decide on LTFs for possible short positions.

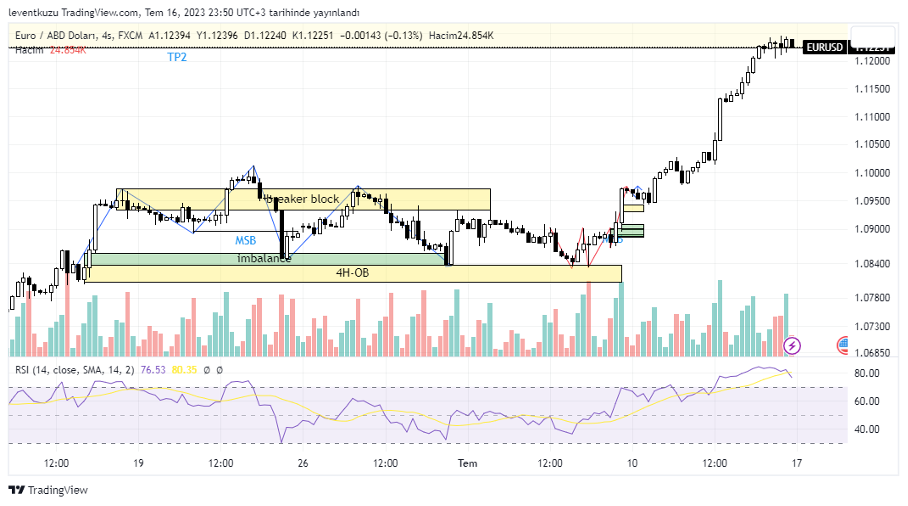

4H analysis

The order block reached three times well and enough orders were filled to carry the pair to higher prices. The price of the pair reached a premium zone on HTF. The pair is within a consolidation and RSI is losing its momentum. These shows a possible price reversal of the pair.

15 min analysis

On 15-min chart two important high and low swing points are shown. After closing candle under the last swing low, the structure of the pair changed its character. Now we can search for short entries. Another fact it that, the price couldn’t close candle over swing high line. Just the liquidity of this level was taken. The imbalance zone around 1.11 can be a possible target.

** Important Note: Above ideas are not investment advice!**

Nihat Çetinkaya

https://twitter.com/nhtctnk

I’m a private trader of over 7 years, based in Istanbul.

All trading and research are my opinion, not investment advice.