BTCUSDT

1D analysis

Last week we told about a channel type movement of HTF of BTC price. A Wolfe pattern is possible with the current price movements. On the daily chart, there is also a negative RSI divergence. Also, there is a fair value gap below. These reasons attract the price to lower regions. If these reasons activate the Wolfe pattern, then we expect the price to reach $25,000.

1H analysis

There is a shallow rising parallel channel that resembles a range structure on 1H chart. After the strong bullish movement on October 24, price swept this liquidity last week. But the short positions were successful until the lower boundary of the channel. Price tried to cross equilibrium of the channel, however, it was unsuccessful twice. As the price is struck between the blue zone, price may want to sweep more liquidity to reach the FVG zone below.

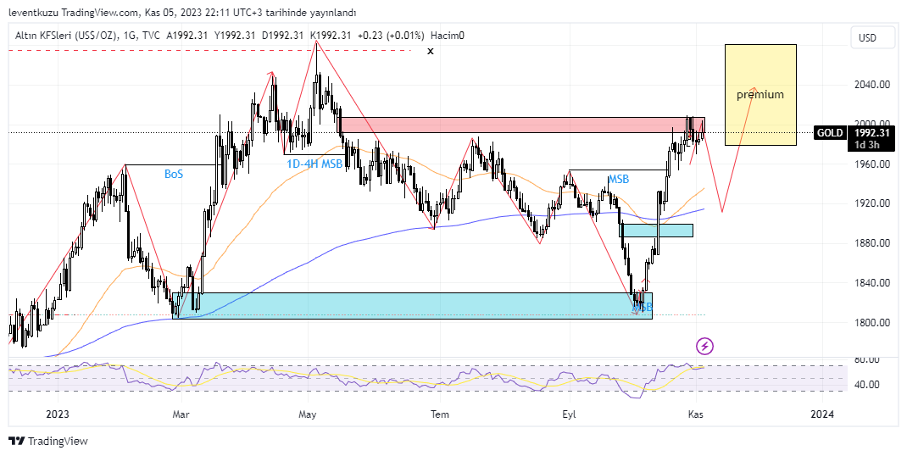

XAUUSD

1D analysis

There was some up and down price movements for gold last week. But the price was at the same level at the end of the week. Nothing has changed on higher time frame perspective. More logical expectation can be the price to reach the balance price range between $1,880-$1,900 zone, and then continue its bullish movement by making all time high.

1H analysis

On 1H chart, price makes a range time price movement. Actually, we could not observe a definite price trend on 1D analysis. On LTF this type of movement can be considered as a range behaviour. Range high and range low lines can be validated through the reaction of the price from the equilibrium line. Actually, price was reacted several times from fib 0.5 of the range. As we expect bullish attitude from the price, the price can make a similar movement as the blue path. First, make a deviation, retest the range high line, and then keep bullish trend.

EURUSD

4H analysis

As with the analysis of the last week, price did not change its market structure. The structure is still bullish on 4H time frame and the pair price is increasing by forming clear higher highs and higher lows. The price sept the same liquidity second time, probably to use it as a fuel for bullish movement. The price from the start of October can also be treated as a channel move. 1.086 is the premium zone for a daily chart and pair price can reach there unless a change of character is observed.

15 min analysis

On 15 min chart, price made a break of structure, showing the continuity of the current market structure. Break of structure was formed by a strong candle that generated fair value gap. On the other hand, there is a bearish RSI divergence because RSI dropped with the increasing price. Price may want to fill the gap around FVG zone and touch MA200, then continue to its bullish movement until HTF analysis target.

** Important Note: Above ideas are not investment advice!**

Nihat Çetinkaya

https://twitter.com/nhtctnk

I’m a private trader of over 7 years, based in Istanbul.

All trading and research are my opinion, not investment advice.