BTCUSDT

1D analysis

On the daily outlook, the long waited range is now broken to the below. It swept one previous liquidity and removed some fair value gap. Fortunately, there is bullish RSI divergence. This is a sign for reversal. Its target will depend on the lower time frame chart. The probable price path is shown by the red line.

1 H analysis

After the price fall, several fair value gaps were formed. But before that we can see the liquidity was swept above $63ks.Price increaed from $53.5k to 58k. There can be a little correction from the current price and then the targets will be the FVGs.

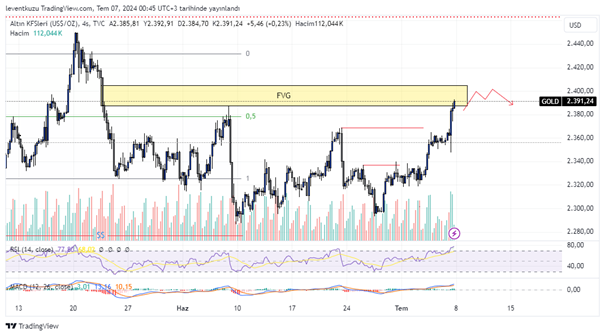

XAUUSD

4H analysis

Gold price is still compatible to the expectations. The price entered the fair value gap zone. Now, close liquidities were swept. Price can somehow rest within the fair value gap. After that, we may expect some reversal. Because other FVGs were formed during the upward price movement.

15 min analysis

The market structure is bullish. But according to recent prices, we can see that it is hard for the price to be pushed upward. RSI is declining although price is increasing. This is a weakness for gold. We may expect reversal within the FVG zone.

EURUSD

4H analysis

Previous expectation was for the price to fill the fair value gap and then continue to downwards. But Price did not reverse from FVG. Instead, it retested and kept the upward movement. The price will probably fill the above imbalance and then start declining.

15 min analysis

There is not a clear sign of reversal on the lower time frame chart. The pair price is keeping its upward move. If we consider the last up leg as an impulsive wave, we can see the critical price values on the chart to be broken. 1.078 is critical in terms of the market structure. Unless these is a candle close under that value, the price will reach above fair value gap.

** Important Note: Above ideas are not investment advice!**