BTCUSDT

4H analysis

BTC continues its bullish movement. In the current figure, there is not bearish signs. HTF target was shown last week and price formed a cup shape. Price may want to draw a handle like shape. Therefore, retracements to EMA levels shown in the figure is possible. On the other hand, we can observe an obvious downtrend of RSI contrary to price of BTC. This can be a sign for retracement in the price of BTC. However, it can be considered as an opportunity to take long positions.

15 min analysis

After forming a sharp movement as a retracement imbalances were formed on different directions. In most cases, price first wants to touch the union set of these imbalance regions. If this happens, $67,500 will be regarded as a fine entry place for long positions.

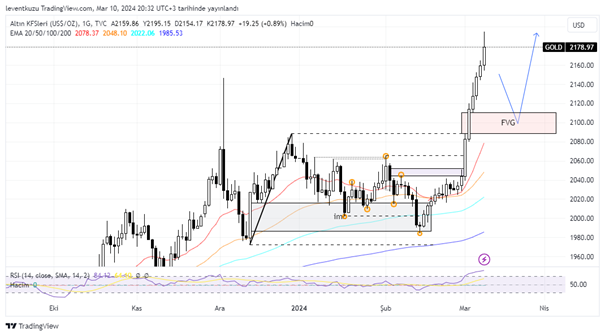

XAUUSD

1D analysis

Our expectation for gold was to reach $2,090 last week. It was achieved and went well above this value. The price is at all time high level. The price was between the dashed range and above this level, the price left a fair vale gap. The gap is around $2,100. It is now expected to test this value and then continue its bullish movement. EMA20 will also be tested within FVG zone.

1H analysis

In short term analysis, there is a steady increase in the price of gold. EMA20/50/100/200 are all parallel to each other. Unless there is a deviation on EMA20, price can continue its bullish trend. Once the trend is broken, price can move back to imbalance zone shown with red colour.

EURUSD

1D analysis

On the daily chart, price made a bearish market structure break previously. Price moved close to the fair value gap, shown with yellow box. But it was unable to fill the gap. The price is within the range of last down red leg. There is no clear trend. The closest expectation is to reach the imbalance and after filling it, continue its bearish price movement.

1H analysis

Although there is a range movement in the daily chart, a bullish market structure break was formed on 1H chart. EMA regions are likely best places for retracements. After price makes a retracement, long positions can be taken. The target will possibly be the imbalance around 1.11 pair price.

** Important Note: Above ideas are not investment advice!**