BTCUSDT

4H analysis

Short term target is still shown on 4H chart to show the accuracy of the path and to understand the importance of the last fair value gap zone. During the internal bearish movement, another buy-side fair value gap was formed. Although it is not easy for the price to move upwards, several FVG zones were left behind at premium side. In the current market conditions, the target of ATH now has a less probability. At first, we should focus on the above price fair value gap zones for price reversal.

15 min analysis

In a suitable market condition, a bearish bat pattern can form. The bearish order block on 15 minute chart is a favourable place for possible short positions. Under that block, there are significant fair value gaps on 15-min chart. In any case, ATH target is not validated in the current time frame. The strength of 15 min OB should be checked for a short entry or a market structure break for any entry decision.

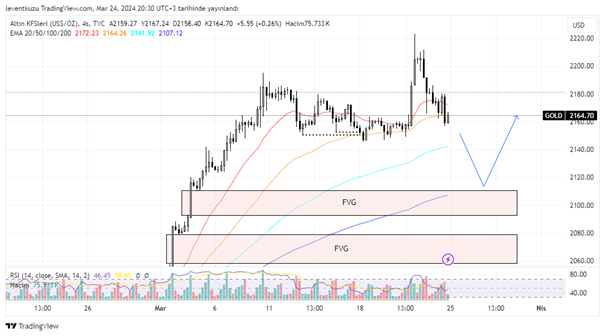

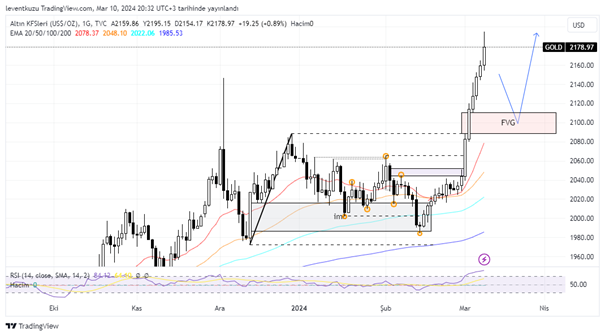

XAUUSD

4H analysis

The target of last week was to reach the bearish order block and then move to cheaper targets at higher time frame nearly around $2,100 level, where several fair value gap zones are available. This target was first hit by reaching the 4H bearish order block, which was depicted previously. The candle there shows the efficacy of the order block. The price will first move to EMA200 with bearish candles around $2,300.

15 min analysis

Under 4H bearish order block, a 15-min bearish order block was formed and it was filled. Although the structure is bearish, we have to search for any other point of interest for a short position. The closest POI is a fair value gap above, which worth taking short position until the fair value gap available below.

EURUSD

4H analysis

Previously depicted fair value gap was partially filled by the price movement of the EURUSD pair price last week. Bearish signs were obvious and started to move lower prices but revisited the edge of the order block. This was not enough to make a market structure shift in the current time frame. The target of the structure is still the same as last week, which is the 4H fair value gap below around 1.058.

15 min analysis

A typical range-like structure was formed at the current price level. Equilibrium of the range worked several times well, showing the efficacy of the range. Double-sided aggressive movements made deviations over the range. The probable path of the price is depicted by the red lines. Range-mid is the possible highest target. Then, range-low can be broken by bearish movement. After that, a retest will be for confirmation of a short position.

** Important Note: Above ideas are not investment advice!**